What Are The Differences Between NAFTA & USMCA (U.S.-Mexico-Canada Agreement)?

Recently, the United States, Canada, and Mexico reached an agreement to revise the 25-year-old North American Free Trade Agreement (NAFTA). The USMCA, or “NAFTA 2.0.,” has been finalized, and in this updated agreement, the goal is to have more car and truck parts made in North America to qualify for zero tariffs. As it stands now, USMCA is expected to have a profound impact on the automotive industry, particularly with:

- Increasing U.S. Automotive Production Manufacturing

- Increasing Automotive Job Wages

Ultimately, the USMCA will require the supplier-to-OEM relationship to be much stronger and closer than in the original NAFTA. Companies like PHB Corp., a U.S. die casting manufacturer for the automotive industry, understand that their strategic advantages over other U.S. and Mexican suppliers make them more proactive in preparing for the new marketplace rules.

USMCA Increases United States Automotive Parts Production

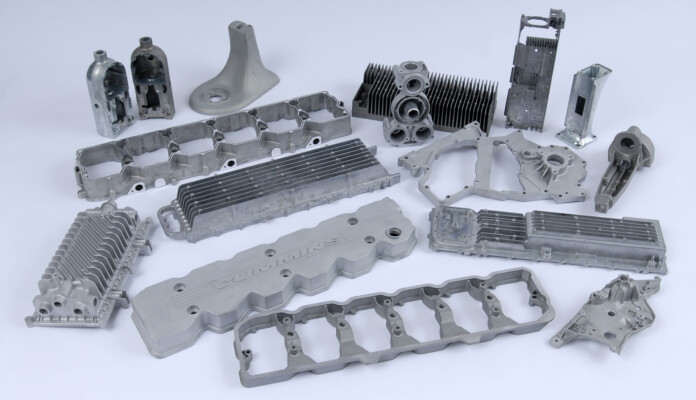

In the USMCA, the Rule of Origin states the United States requires 75 percent of auto content to be produced here, resulting in the regional value for U.S. suppliers beginning to increase in value. In addition to the 75 percent production requirement, the new USMCA now stipulates that 70 percent of the metal used needs to be “melted and poured” in North America as well. This clarification closes the door on the use of semi-finished metals from China or other countries.

For example, U.S. suppliers will see a resolution to the NAFTA agreement that incentivizes low wages in automotive parts production. Along with this resolution, the USMCA will also incur billions of dollars annually, preserve and re-shore vehicle and parts production in the United States, and transform supply chains to use more United States content – especially content that is key to future automobile production and high-paying jobs.

USMCA Facilitates Higher Paying Wages in the Automotive Industry

As USMCA helps increase U.S. regional value, this deal also helps create new labor value. With the USMCA, we will receive higher wages by requiring that 40-45 percent of auto content be made by workers earning at least $16 per hour. This requirement for Mexico and Canada to supply higher-paying jobs will ensure that U.S. producers and workers are able to compete on an even playing field, incentivize new vehicle and parts investments in the United States, and encourage more investment by auto companies in research and development across the region.

How the USMCA Affects Mexican OEMs When Exporting Automotive Parts to the U.S.

While sourcing in Mexico may still be a cheaper solution, Mexico lags far behind the U.S. in research and development capabilities, as well as many of the benefits that come with near-sourcing. These include the ability to work with the manufacturer on prototyping, design changes, and meet in person to develop new solutions. All of these tasks become more difficult with a Mexican supplier than a U.S. supplier because OEMs are still fighting language barriers, location barriers, etc.

New Developments in Mexico & Their Impact on U.S. Automotive Manufacturers

When considering the USMCA, it is also important to factor in some of Mexico’s political actions. Mexico’s president is only in his second year of a six-year term, pushing his populist message to raise wages, restrain industry, expand regulation, and raise taxes. He began by targeting the energy sector and limiting production. This increases the price of energy in Mexico, leading to higher manufacturing costs. With the USMCA rule about $16/hr wage for automotive OEMs, the president also increased Mexico’s minimum wage by 16.2 percent and raised the minimum wage along the U.S border to $8.80 per day – doubling the previous daily wage.

Mexico’s consumer protection agency, PROFECO, is also taking more steps to monitor compliance. The legal system now allows more exposure to manufacturers in Mexico, which will increase liability costs. The Mexican government now has the authority to impose sanctions on non-conforming companies. As Mexico is still considered a “developing country,” it is not listed under DFARs as an acceptable supplier of specialty metals for the U.S. defense industry.

USMCA will indeed expedite the movement of some goods across the border. However, with the increases in wages, the barriers OEMs still have to face, and the overall time it takes to transport the end product, outsourcing automotive production becomes just as expensive and more time-consuming than automotive manufacturing in the United States.

With the USMCA requiring higher percentages in U.S. automotive manufacturing than NAFTA’s 62.5 percent requirement, alongside an increase in wages and the new standards and limitations in Mexico, OEMs have less incentive to outsource car parts. Additionally, these provisions in the USMCA will boost demand for American-made car parts, incurring an estimated $34 billion worth of investments in the U.S. automotive sector. Those investments will create 76,000 additional U.S. jobs in the automotive production industry.

PHB is a Leading U.S. Aluminum Die Casting Manufacturer for the Automotive Industry

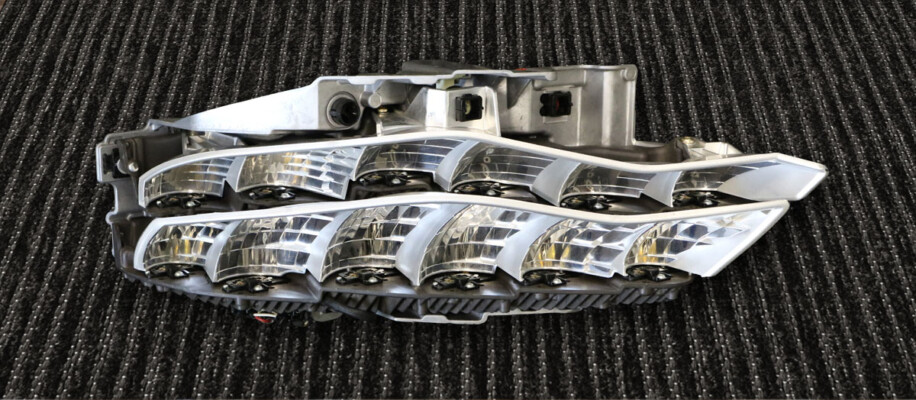

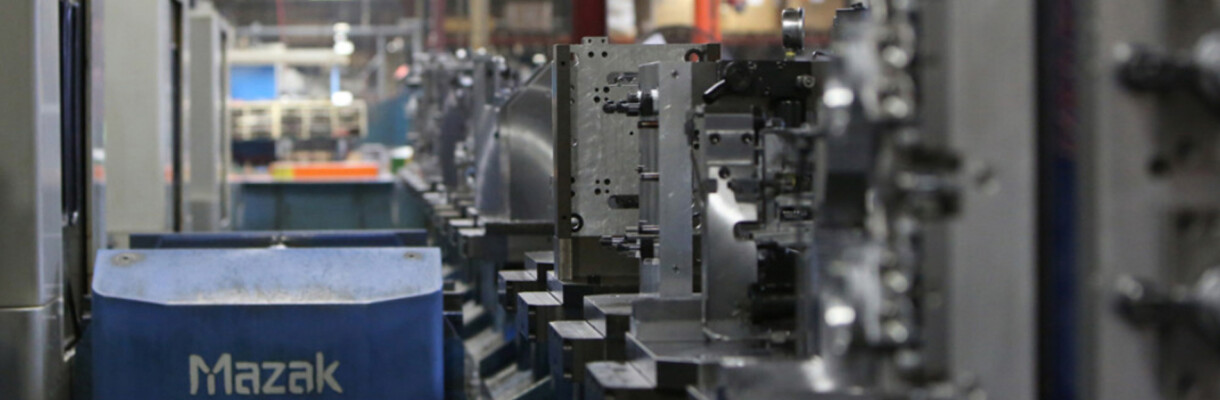

Choosing U.S.-based manufacturing means creating jobs here at home for Americans. PHB Inc. is a U.S.-based company and full-service manufacturer of quality aluminum die casting, zinc die casting, CNC die casting machining, and contract CNC machining for the automotive industry. As an ITAR registered and IATF certified die casting company, PHB serves manufacturing companies and OEMs the demand the highest level of quality for government and military work.

[/wpv-noautop]